PPI performance:

2021-q4

25 March 2022

On March 10, 2022, De Nederlandsche Bank (DNB) published various data on the market for premium pension institutions (PPIs) for the fourth quarter of 2021. We provide an overview of the developments.

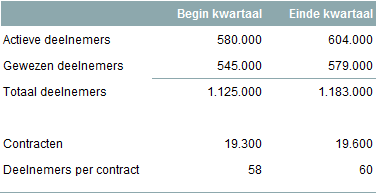

Number of participants

The table below shows the (rounded) figures at the beginning and at the end of the fourth quarter of 2021. At the end of the quarter, there are 604,000 active participants, an increase of 4.1% compared to the beginning of the quarter. The number of former participants also increased, by approximately 6.3% in this quarter. A total of approximately 19,600 pension contracts have now been concluded with PPIs. This means that a rounded pension contract has 60 (former) participants.

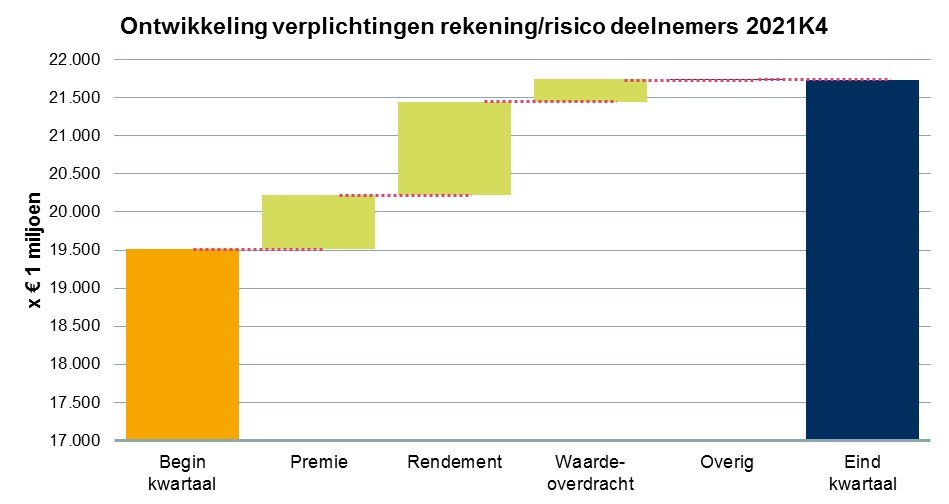

Development of obligations for account and risk participants

At the start of the fourth quarter of 2021, there were approximately €19.5 billion in liabilities in the PPI market. During the fourth quarter of 2021, these liabilities increased by approximately 11.4% to approximately €21.7 billion. This increase in liabilities is due to both premium contributions and positive investment results.

The investment result in the fourth quarter was 6.1% on average.

We will publish our annual report Lifecycle Pension 2022 again in May. In this report, we provide more insight into the lifecycle returns for the whole of 2021 for both younger and older participants.

The figure below shows the development of the liabilities for account and risk participants of PPIs during the fourth quarter of 2021.

The premium was equal to €711 million in the fourth quarter of 2021. Converted this is approximately € 401 per active participant per month. In the third quarter of 2021, the premium was approximately €362 per active participant per month.

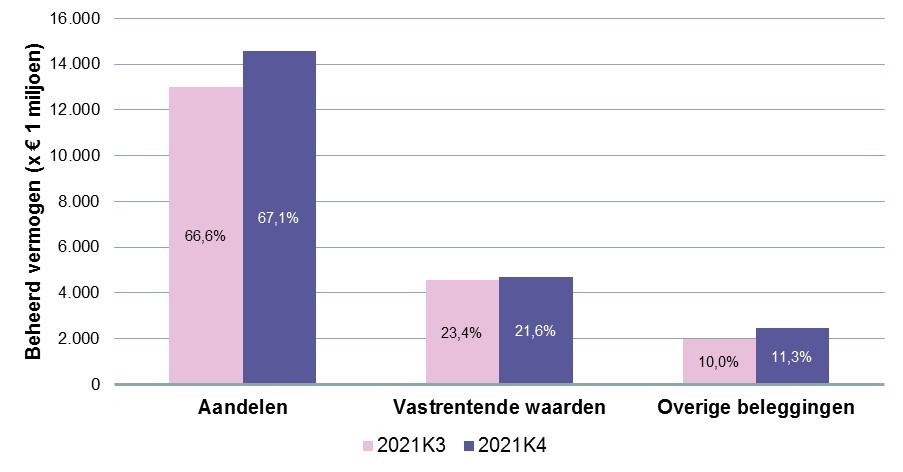

investment mix

The figures published by DNB distinguish between assets under management in shares, fixed-income securities and other investments. The figure below shows the distribution of assets under management over the aforementioned three categories at the beginning and at the end of the fourth quarter of 2021. The percentages indicate what percentage of the assets under management is invested in the relevant category.